do nonprofits pay taxes on interest income

Although 501 c 3 organizations dont pay tax the IRS requires them to report revenue and expenses just like a company that is subject to tax. Nonprofit organizations are exempt from federal income taxes under subsection 501 c of the Internal Revenue Service IRS tax code.

How Nonprofits Obtain And Maintain Their Nonprofit Tax Status Hr News

However this corporate status does not automatically grant exemption from federal income tax.

. Do nonprofits pay taxes. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it. Nonprofits are exempt from federal income taxes based on IRS subsection 501c.

Do nonprofits have to pay taxes on investment income. However there are two exceptions where this type of income is taxable. There is a rare exception to this rule though.

But nonprofits still have to pay. An organization must pay estimated tax if it. Nonprofits are exempt from federal income taxes based on IRS subsection 501c.

Yes nonprofits must pay federal and state payroll taxes. The answer to this question is YES. Nonprofits engage in public or private interests without a goal of.

Following this logic the short answer to the question Does an HOA pay taxes is yes. Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Nonprofits typically dont have to pay federal income taxes. While the IRS usually excludes investment income from a nonprofits taxed unrelated business income it will usually tax investment income from for-profit subsidiaries or. An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF.

Key criteria that nonprofits must meet. Do Ihave to pay taxes if I work for a nonprofit. Your recognition as a 501 c 3 organization exempts you from federal income tax.

Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two. There are other types of exempt nonprofits such as 501c4 social welfare organizations. General Rule By and large interest is not subject to income tax for nonprofit.

One of the purposes of the. This is because nonprofits are typically organizations that exist for public and private interest with no interest in making a. Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and.

The income you earn by working for a nonprofit organization is subject to federal and. Whether a nonprofit corporations interest is subject to income tax depends the incomes source. If your HOA registers as a non-profit with the IRS and.

Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT.

Nonprofit Resource Development And Fundraising Asu Lodestar Center For Philanthropy And Nonprofit Innovation

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

501 C 3 Vs 501 C 6 A Detailed Comparison For Nonprofits

What Nonprofits Need To Know About Sales Tax Taxjar

Unrelated Business Income Tax Information For Charities Other Nonpr

The Nonprofit Starvation Cycle

9 Ways To Reduce Your Taxable Income Fidelity Charitable

10 Ways To Be Tax Exempt Howstuffworks

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Pdf Taxation Of Non Profit Associations In An International Comparison

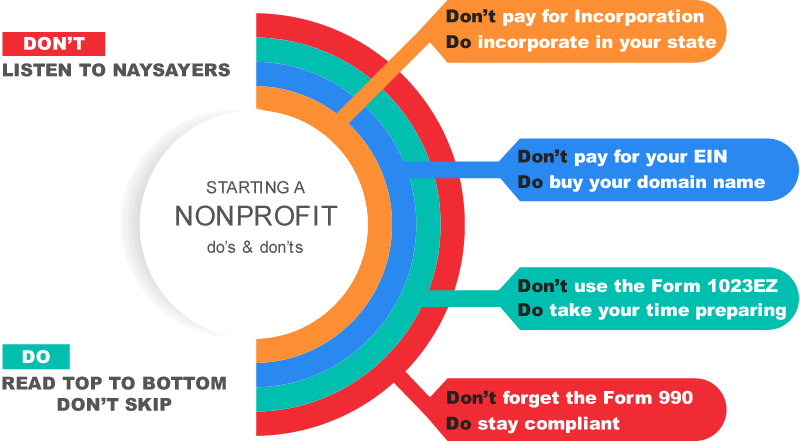

Starting A Nonprofit How To Start A 501c3 Non Profit

How Do Nonprofits Make Money Making Nonprofits Profitable Jitasa Group

Should Nonprofits Seek Profits

Understanding New Revenue Recognition Guidelines For Nonprofits

Should Nonprofits Have To Pay Taxes The Pew Charitable Trusts

Tax Exemptions For Nonprofit Hospitals A Bad Deal For Taxpayers Stat

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors

What Are Tax Exempt Organizations Asu Lodestar Center For Philanthropy And Nonprofit Innovation

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)